Why Are Hyperscalers Building in the UAE?

It's probably not for cheap energy.

US hyperscalers have announced billions of dollars in planned data center investments in the UAE over the past few years. Microsoft is planning to spend $15.2 billion through 2029. AWS committed $5 billion by 2036. OpenAI, Oracle, and Nvidia have invested in Stargate UAE, a planned multi-gigawatt campus in Abu Dhabi.

There’s a perception in policy circles that this is because the UAE is probably a much cheaper place to build data centers, with inexpensive electricity and fast build times, and so it’s reasonable that hyperscalers are clamoring to build there instead of in the US.

I don’t think this perception is quite right. I recently published a report where I modeled the intrinsic cost of building and operating a 100-MW data center in the US and the UAE. The model includes operating costs (like electricity or operating labor), capital costs (like buying the chips and paying to build the facility), and time costs (the costs associated with pre-operational delays from permitting or construction). I find that costs are quite similar – if anything, slightly higher in the UAE than in the US.

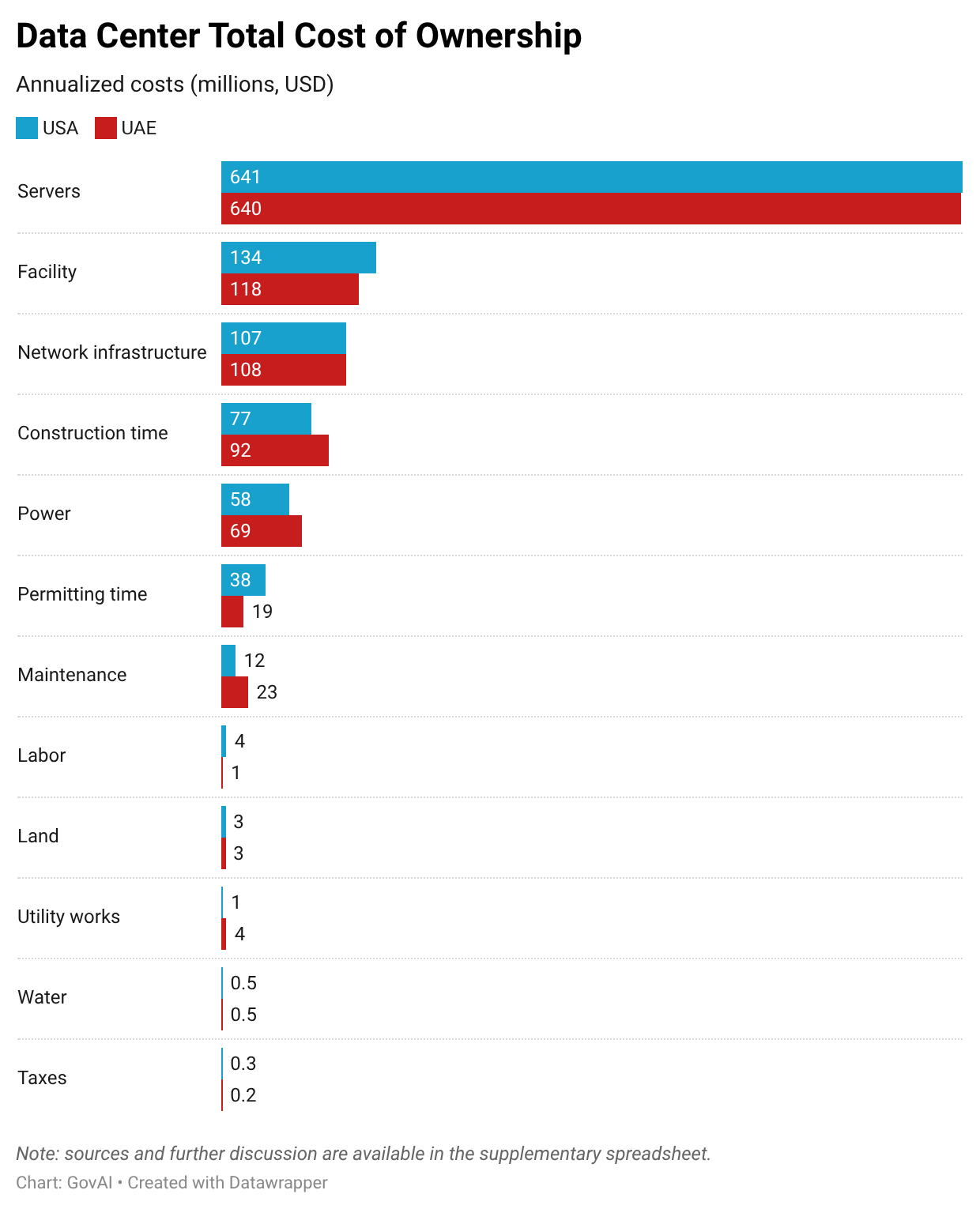

The figure below shows how the US and the UAE compare on all major cost items. Most are similar across the US and UAE, with differences arising mainly from electricity prices, maintenance costs, facility construction expenses, and permitting and construction delays.

As I note in the report, a number of these estimates are highly uncertain due to data limitations. (You can refer to the report for a more detailed description of my uncertainties.) However, for many relevant cost categories, it’s fairly clear that the UAE does not have a substantial advantage.

There are a few features of the UAE that explain why, perhaps counterintuitively, building in the UAE costs about the same as building in the US. I walk through these below.

The UAE doesn’t have especially cheap electricity

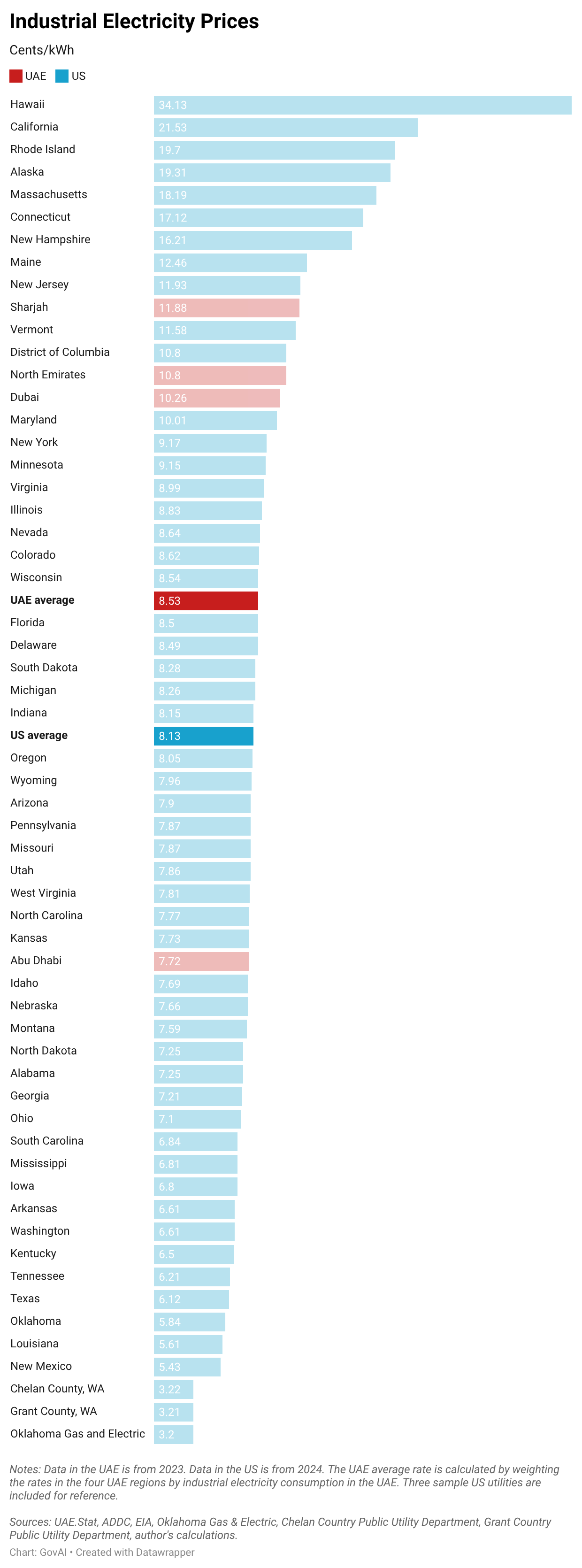

The UAE is oil-rich, but it’s scarce in natural gas. This means that the UAE mostly relies on imported natural gas to produce electricity (oil-fired power plants are relatively inefficient). This is expensive. In fact, the UAE subsidizes its electricity to keep it affordable for consumers. (The UAE has started to diversify its energy mix with nuclear and solar, but it still generates most of its electricity with natural gas). The effect of this is that even subsidized industrial electricity in the UAE is, on average, more expensive than industrial electricity in the US (see figure below). While there are certainly places in the US with more expensive electricity, the average price in the UAE is higher than the average price in the US. (Rates in the UAE are set at the Emirate level, but rates in the US are set at the utility level, so state values are just averages. A few notably cheap US utilities are included at the bottom of the chart for reference – including ones that are more than 2.5x cheaper than the lowest standard rate available in the UAE).

The desert isn’t a great place to build data centers

The UAE is hot and dusty. This makes building and operating data centers more expensive, and this comes out in the cost estimates in a few places:

Energy efficiency: Data center energy efficiency is worse in the Middle East than in North America; it takes more energy to cool data centers in hot climates. This raises energy costs.

Maintenance: The cost of data center maintenance (e.g., replacing filters, testing critical systems, repairing broken equipment) is likely higher in the UAE than in the US. Data centers in high heat environments tend to require more maintenance, since costly data center components, like uninterruptible power supply (UPS) systems, wear out more quickly when exposed to high heat. The higher risk of dust storms in the Middle East also increases data center maintenance requirements.

Building specs: Building data centers that can operate in desert environments requires higher-spec infrastructure. For example, US data centers typically use air-insulated substations, while data centers in the UAE are more likely to require enclosed gas-insulated substations to withstand harsh conditions. Gas-insulated substations are a lot more expensive–I estimate in my report that building a substation in the UAE would cost over $30 million, compared to around $8 million in the US.

The UAE isn’t faster at building data centers – and hasn’t built big data centers before

In the report, I estimate that data center construction speeds are probably somewhat faster in the US than the UAE.

This difference may owe to the fact that the UAE’s data center industry is comparatively immature. The US has about 90 times the number of data centers as the UAE, with about 100 times the total capacity. The UAE’s data center industry is also much newer than the US’s. The leading data center company in the UAE, Khazna, was started only in 2012. The first UAE hyperscale data centers – two Microsoft Azure facilities – also came online only in Abu Dhabi and Dubai in 2019.

Furthermore, despite plans for multi-gigawatt data centers, the UAE hasn’t built any very large data centers before. The largest fully operational data center in the UAE that I’m aware of is under 35 MW. Construction has begun on larger data centers, like the Moro Hub data center (a planned 100-MW data center that made headlines for being the largest solar-power data center) and Khazna’s QAJ1 data center (another planned 100-MW facility in Ajman that has been marketed as the UAE’s first AI-optimized data center), but they are not complete yet.

The UAE’s lack of previous experience building very large data centers suggests that build times for UAE data centers at this scale may (at least for a time) be disproportionately slow. In line with this hypothesis, I note in the report that the construction of the largest data center projects in the UAE (including the Moro Hub and QAJ1 data centers) seems to be going somewhat slowly. I estimate that the construction of large data centers currently takes about 20% longer in the UAE than the US.

The UAE may very well grow its domestic data center industry and improve its construction speeds over time. Indeed, the most recent project, Stargate UAE, appears to be going more quickly. However, for the time being, the US’ robust domestic data center industry seems to put it at an advantage.

The UAE still has some cost advantages

One cost benefit the UAE probably has is permitting speed: while I estimate that the construction process is faster in the US than the UAE, the UAE permitting process is probably faster than in the US. The exact estimate of permitting speed is fuzzy. Because there isn’t reliable data on permitting times for data centers in the UAE (and because there haven’t been many big data centers to look at), I use the relative permitting speeds for large energy projects in the US and the UAE as a proxy. Across all of these, the UAE has much shorter permitting processes. This is likely because a lot of large projects in the UAE are state-run or state-back, and the UAE is strongly centralized.

It’s also probably cheaper to build the data center facility itself in the UAE (I estimate about 10% cheaper than in the US), likely due to the fact that construction labor is a lot cheaper in the UAE. Building the facility is the largest capital expenditure after the servers themselves, so this cost difference is not insignificant.

The UAE might also benefit from fewer delays than the US in connecting large loads to the grid (a process known as interconnection), though the comparison is unclear. I don’t model interconnection delays, mainly because there’s limited good data on interconnection timelines in the US, let alone in the UAE. From what data there is, it’s also hard to glean the severity of delays in the US, because the queue of projects attempting to connect to the grid is filled with speculative applications. This does not mean that interconnection is not important – the ability to secure power appears to be one of the greatest determinants of where hyperscalers choose to build data centers. The exclusion of the costs of interconnection delays is, in my view, the most likely reason my analysis could be wrong. Based on the limited evidence that’s available, though, it’s unclear how interconnection times likely compare between the US and the UAE: the US has a much larger grid, which probably enables it to accommodate more data center capacity in some regions, but the US likely also has a more backlogged interconnection review process.

So, why are hyperscalers investing in the UAE?

These results should be considered speculative, since many of the cost estimates are based on extrapolation from limited publicly available data. The modeling also excludes certain costs, including the cost of delays associated with connecting to the grid.

If the key estimates are roughly correct, however, this suggests that US companies’ current interest in UAE-based data centers is potentially driven by factors other than the cost components modeled here. The following are a couple of potential explanations for hyperscaler interest in the UAE despite the lack of a clear cost advantage:

Large-scale subsidies: The UAE already provides various subsidies to data centers and other valued industries, including additional electricity subsidies, government land, and significant infrastructure investments. Additionally, while the specific structure of the deals is not known, the UAE’s agreements with companies like Microsoft, OpenAI, and other hyperscalers plausibly constitute significant financial support. While both the US and the UAE view data center build out as a priority, the UAE is probably more willing to heavily invest government resources to incentivize domestic data center buildout.

Anticipation of future cost decreases: For example, hyperscalers might expect that electricity will get less expensive in the UAE as they continue to build out more solar and nuclear energy.

Belief that participation in data center projects will unlock future business opportunities: In particular, reciprocal deals might be a meaningful factor. A few examples of these are G42’s commitment to expand its use of Microsoft Azure and Cloud when Microsoft invested in G42, or the UAE Stargate deal, which involved reciprocal UAE investment in US Stargate infrastructure.

Desire to hedge against risk of delays in the US: Data center construction delays are really costly to hyperscalers, and they may be willing to pay a large premium to reduce the risk of not having capacity ready when they need it. To do so, they may sign on to more projects than they strictly need in potentially suboptimal locations to minimize the chance of overall delays, especially as it becomes increasingly difficult to find sites that enable large-scale data center projects.

What does this mean for the US?

The US appears to have some genuine structural advantages in building data centers, including cheaper electricity, a more hospitable natural environment, and a more robust domestic data center industry. This does not, however, guarantee that the US will maintain its edge.

There are various ways the US could lose its edge to the UAE. On the US side: energy procurement in the US might not speed up quickly enough, or the interconnection processes might grow prohibitively long. On the UAE side: the UAE could become faster at building very large data centers. It seems possible that the UAE’s relatively slow construction times on large data centers – which I estimate is one of the largest cost disadvantages of the UAE – is due to their relative inexperience in building large data centers. It seems likely that this is something that the UAE could get better at, just by building up know-how and infrastructure through the process of constructing more data centers.

This suggests that it is neither inevitable that the UAE will become a major hub, nor is it guaranteed that the US will continue to be one of the most attractive places to build data centers. If the US wanted to maintain its dominance in data center buildout, there doesn’t appear to be a structural reason that it couldn’t – but it would likely take significant political will to build the energy and infrastructure necessary for large-scale buildout.

Update (Jan 2026): I’ve corrected an error in the tariff rate estimate for Abu Dhabi. The charts above now reflect the updated values.